Preparing for earnings |

Sideways trading for US markets yesterday as the focus will shift from macro to micro over the next few weeks with a new reporting season underway. |

We will kick off today with many US large caps including JP Morgan. The market is looking for around a 4% move over the next two days for the name. |

BLK is also due today and is expected to move around 3.5% over the next 2 trading sessions as well as DAL with the market looking for a price change of around 4.75% over the next two days. |

Some more names will be reporting on Thursday as well with UNH (market looking for around 3% over the next 2 days), C (market looking for 4.1% move over the next 2 days), GS (market looking for 4.4% over the next 2 days) or MS (market looking for 3.7% over the next 2 days). |

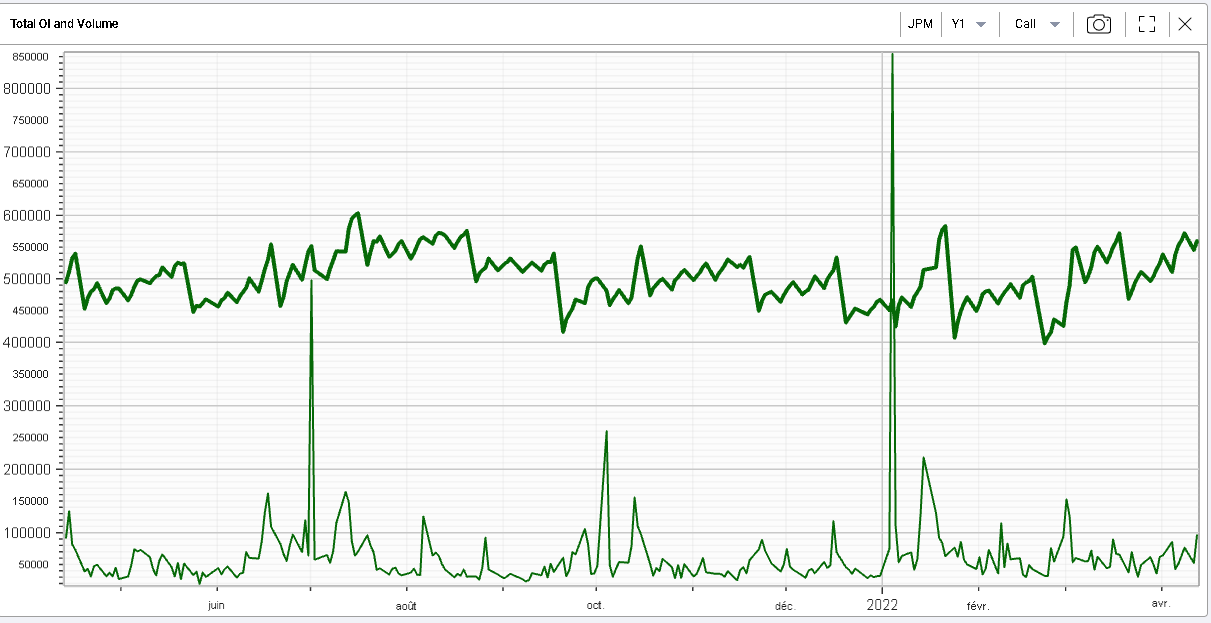

As we approach earnings in JPM, it is interesting to note that the call open interest is sitting at its highest level over the past 12 months. |

|

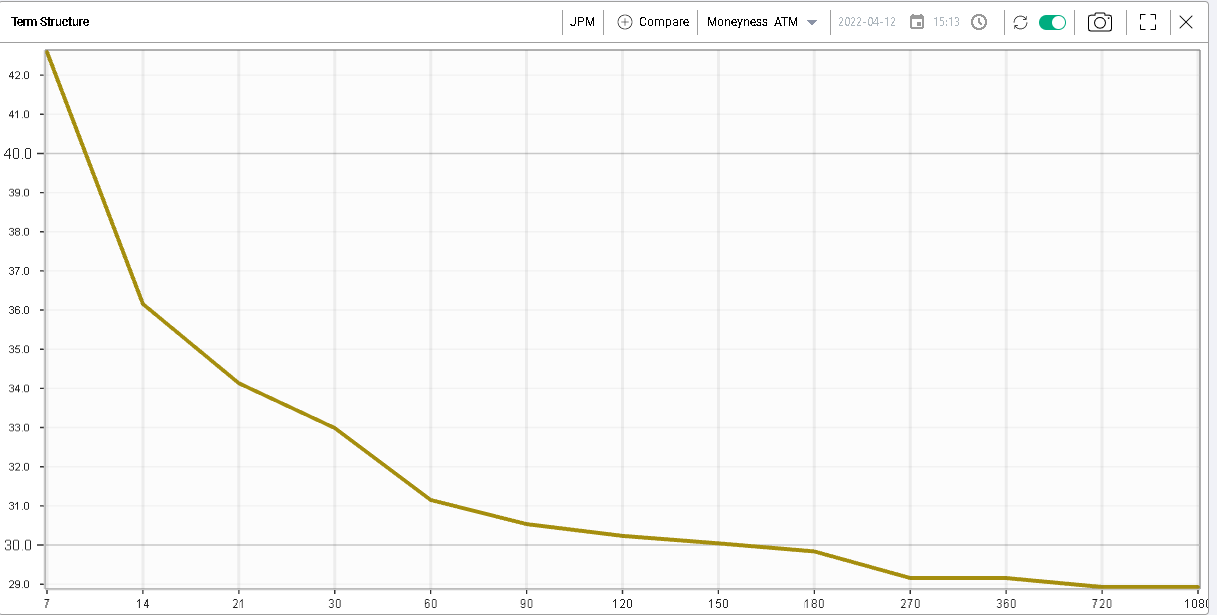

Given the inverted term structure, some traders might be interested in looking at calendar spreads, for instance selling May options to buy June options. |

|

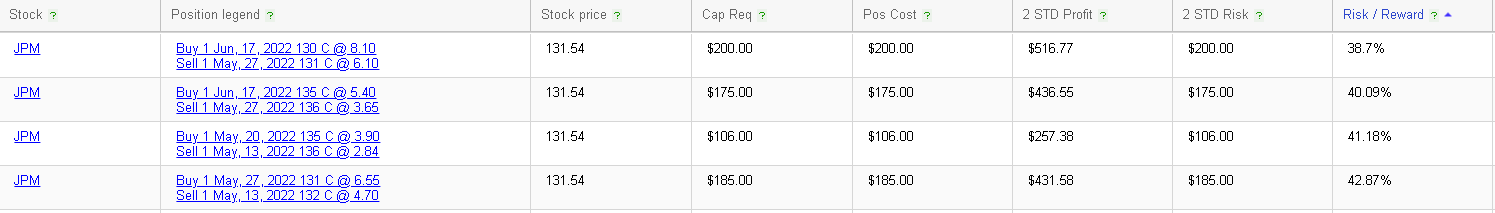

Using the RT Spread Scanner, we are able to identify bull diagonal spreads, for instance the 17th Jun’22 130c vs 27th May’22 131c for $2. |

|

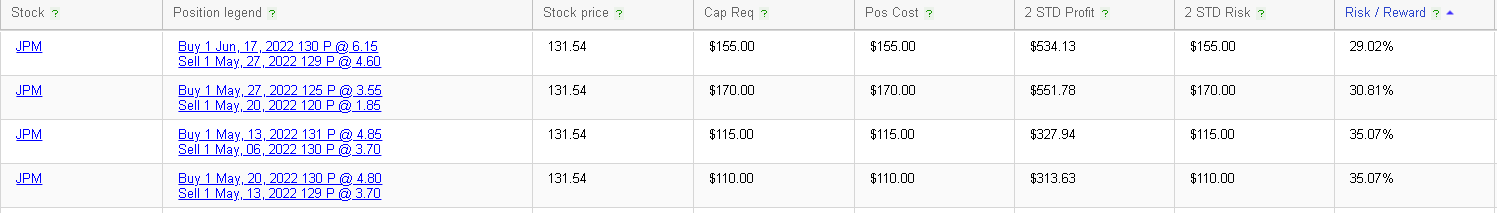

On the put side, the scanner identifies structures such as 17th Jun’22 130 p vs 27th May’22 129p for $1.55. |

|

Disclaimer - This information is provided for general information and marketing purposes only. The content of the presentation does not constitute investment advice or a recommendation. IVolatility.com and its partners do not guarantee that this information is error free. The data shown in this presentation are not necessarily real time data. IVolatility.com and its partners will not be liable for any loss or damage, including without limitation, any loss of profit, which may arise directly or indirectly from the use or reliance on the information. When trading, you should consider whether you can afford to take the high risk of losing your money. You should not make decisions that are only based on the information provided in this video. Please be aware that information and research based on historical data or performance do not guarantee future performance or results. Past performance is not necessarily indicative of future results, and any person acting on this information does so entirely at their own risk. |