Market News & Research - Head & Shoulders Bottom

August 1, 2022

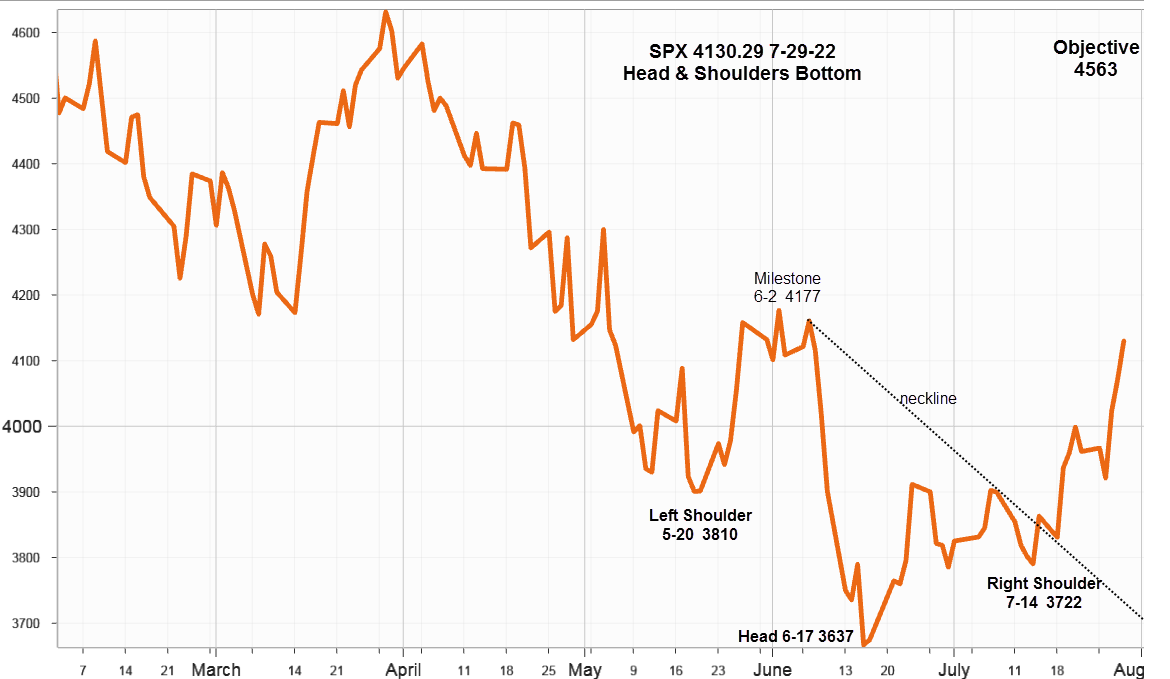

After several weeks anticipating the possibility, it appears the S&P 500 Index advanced enough last week to declare the activation of a Head & Shoulder Bottom, one of the more common and most reliable reversal patterns.

S&P 500 Index (SPX) 4130.29 gained 168.66 points or +4.26% last week with the largest advance occurring during Jerome Powell's comments on Wednesday that closed the open gap at 4017.17 made June 10 on the way down. Then on Friday it closed above the upside measuring objective at 4105 from the small double bottom formed by the July 5 and July 14 lows. Reaching and exceeding these targets validates the activation. Here in bright orange the line chart shows the next milestone at 4177 and the pattern objective at 4563 back up near the March 29 high.

Although right skewed, both the left and right shoulders appear prominently and according to the rules of symmetry both have two lows, although only one for each are shown along with the neckline. The distance from the head to the neckline added to the breakout above the neckline produces the upside measuring objective shown above at 4563 along with the creation of an intermediate double top where it could have trouble.

First, it needs to overcome resistance created in early June marked as Milestone 6-2 4177.

Fed Funds Interest Rate

As widely expected last Wednesday, the Federal Reserve raised the Fed Funds interest rate by 75 bps to 2.25% to 2.50% without providing forward guidance. However, first fixed income and then equities interpreted Chairman Jay Powell’s comments as tilted dovish since the economic slowdown underway will force the Fed to pause further rate hikes after September’s meeting.

U.S. 10-Year Treasury Note

Last week the yield on the U.S. 10-Year Treasury Note declined 10 bps to end at 2.67% after declining 16 bps the week before. Apparently traders and investors at the long end of the curve seem persuaded by the 2Q preliminary GDP report that the recession now underway will soon reduce inflation and interest rates. Many prominent outspoken economists disagree saying the Fed has just started implementing quantitive tightening, or QT by rolling off asset holdings and the markets are too far ahead of themselves.

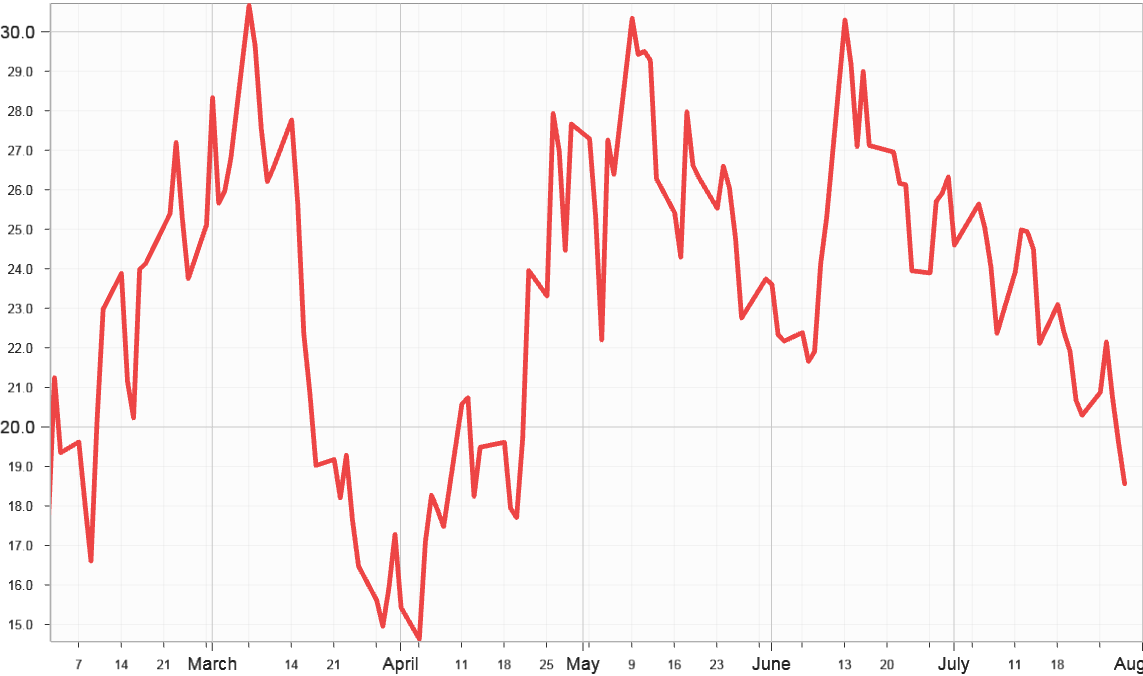

Implied Volatility

SPX options implied volatility index, IVX declined 1.73% to 18.58% from 20.29% on July 22. The current downtrend supports the rising SPX scenario and the Head & Shoulders Bottom upside objective as IVX again approaches the 15% -16% level.

Summing Up

Last Wednesday's breakout followed by further advances on Thursday and Friday support the conclusion that a Head & Shoulder Bottom was activated last week with a an upside measuring objective back near the March 29 high at 4563 since Head & Shoulders formations can't be expected to re-trace more than the minor move that preceded it. Further many notable pundits claim the markets are too far ahead of both important macro concerns and fundamentals.