Taking stock of volatility moves

August 4, 2022

Bulls finally managed to break the 4140 level and rapidly moved prices to the core of the resistance zone between 4170 and 4200 as shown below.

Source: Tradingview.com

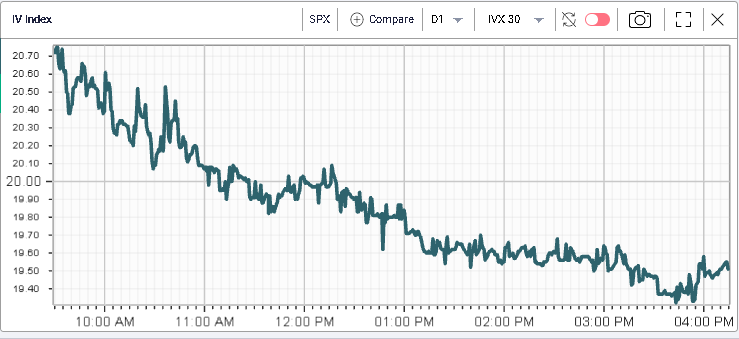

The SPX closed at 4155 (+1.56%), the NDX at 13253 (+2.73%) and the DJIA at 32812 (+1.29%). Implied volatilities drifted lower over the session with 30d IVX for the SPX moving about 1% lower.

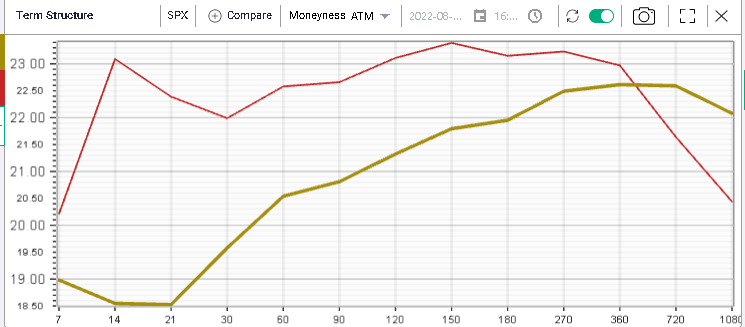

Looking at the change in term structure since the July expiration, we can see that the market has mostly repriced short dated volatilities lower with the 2 weeks IV losing around 4 points and the 30d IV dropping 2.5 points.

For the NDX which started from a much higher base, 14d moved 5 points lower but remains around 25%. Longer term volatilities have remarked even less than for the SPX, for instance 30d IV is around 2 points lower for the NDX.

Looking at the NDX/SPX IV Difference chart, we can see that the spread has remained fairly stable around 6 vols.

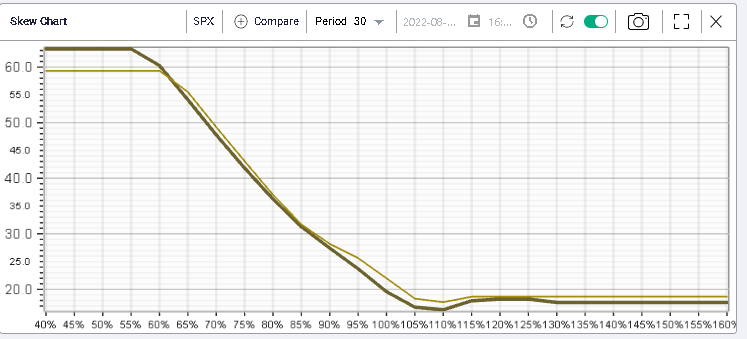

Looking at skew, the dark bold line is as of yesterday while the yellow line is as of the July expiration date. We can see that downside puts have seen their implied volatilities move slightly lower since then while options around the money have been sold more aggressively.