Italian politics in focus

August 16, 2022

Following Draghi’s resignation as Prime Minister of Italy in the middle of July, new elections have been scheduled for the 25th of September 2022.

It may not be immediately obvious to our international audience why such a localized event could matter to them but Italian politics have always found a way to be a worrying event for European markets and might thus trigger some increased volatility.

This time around, there are a few reasons why traders might pay attention to this event.

- The elections will happen at a time when an energy crisis across Europe is looming. Electricity prices in Europe recently hit new high prices as current production is also being impacted by the drought hitting Europe.

- The potential lack of leadership in Italy (the third largest economy in the Eurozone) could translate into a less proactive Eurozone both on the geopolitical and economic fronts.

- Under Mario Draghi, a former ECB President and pro-EU figure, Italy benefited from a generally positive perception by investors as well as foreign and EU politicians. Will a change in government increase the worries from the EU, particularly as the third tranche of the RRP becomes due towards the end of the year. As a reminder, Italy was entitled to around €200bln of funds from the European Union until 2026. A further tranche of around €20bln is due by the end of the year provided that Italy complies with 55 new targets set by former Prime Minister Mario Draghi. How will the EU react if the incoming government tries to renegotiate that part of the deal?

- Furthermore, if Italy is declared as non-compliant under the RRP then it would stop being eligible for the TPI (the Transmission Protection Instrument) launched in July’22 by the ECB in order to prevent spreads between countries of the Eurozone from widening excessively, in particular during the rate hike period. If Italy was declared non-compliant, would spreads widen on worries that the ECB might not be in a position to intervene?

- The uncertainty around the outcome of the election remains very high. The electoral law in Italy specifies that the first party would automatically get 37% of all outstanding seats in both the Chamber and the Senate with pretty much all of the other seats allocated proportionally. This creates a lot of uncertainty and a significant premium for the party finishing in first position at the polls.

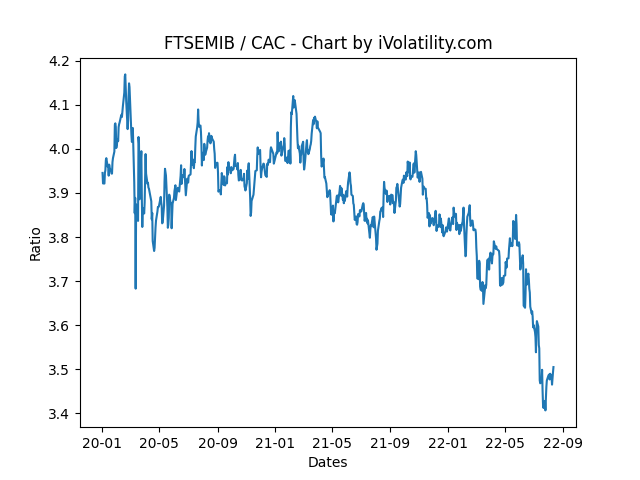

The below chart shows the ratio of the benchmark Italian FTSEMIB over the benchmark French CAC40 created using the iVolatility.com REST API service (more information: https://redocly.github.io/redoc/?nocors&url=https://restapi.ivolatility.com/api-docs)

The underperformance of the Italian index since the political tensions started to emerge in the middle of Jun’22 is quite visible on the above.

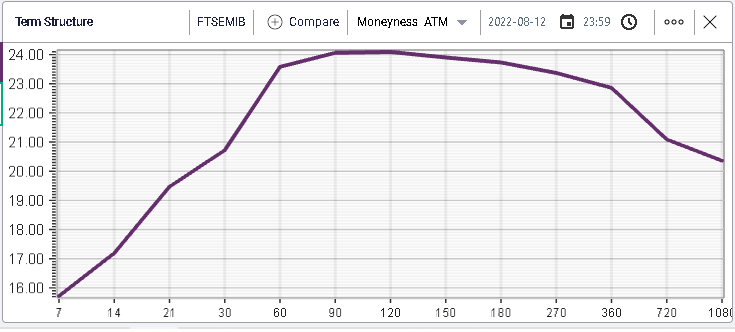

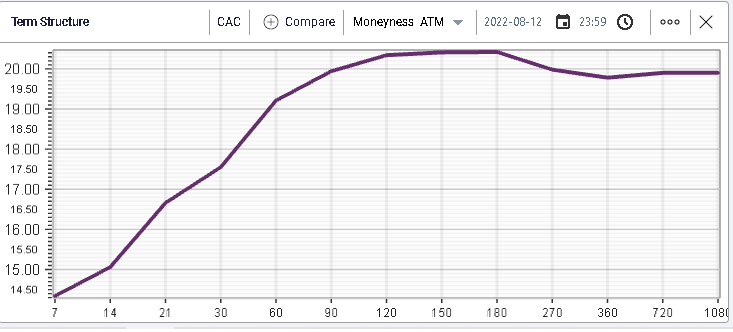

Looking at the term structure of volatility as of the 12th Aug’22, we can see that in the short run, option traders are pretty comfortable with implied volatility in the Italian index being below 20% although it appears fairly clearly that as we go further out in time, the premium requested for selling options grows with 90 days options priced with an implied volatility of 24%.

This phenomenon is generally true for French CAC options as well as shown below although the magnitude is slightly smaller. For the FTSEMIB, 7 days options are priced at 16% while 90 days are priced at 24% or 8 points premium. For the CAC, the 7 days options are priced at 14.5% while the 90 days options are priced at 20% or 5.5 points.

Looking at the FTSEMIB 90 days implied volatility compared to the CAC 90 days implied volatility shows that the spread is currently trading above a 4 points premium which, over the past 5 years, has mostly happened in crisis period, for instance in early 2018 with the arrival of the Five Star Movement in power or in 2020 with the pandemic.

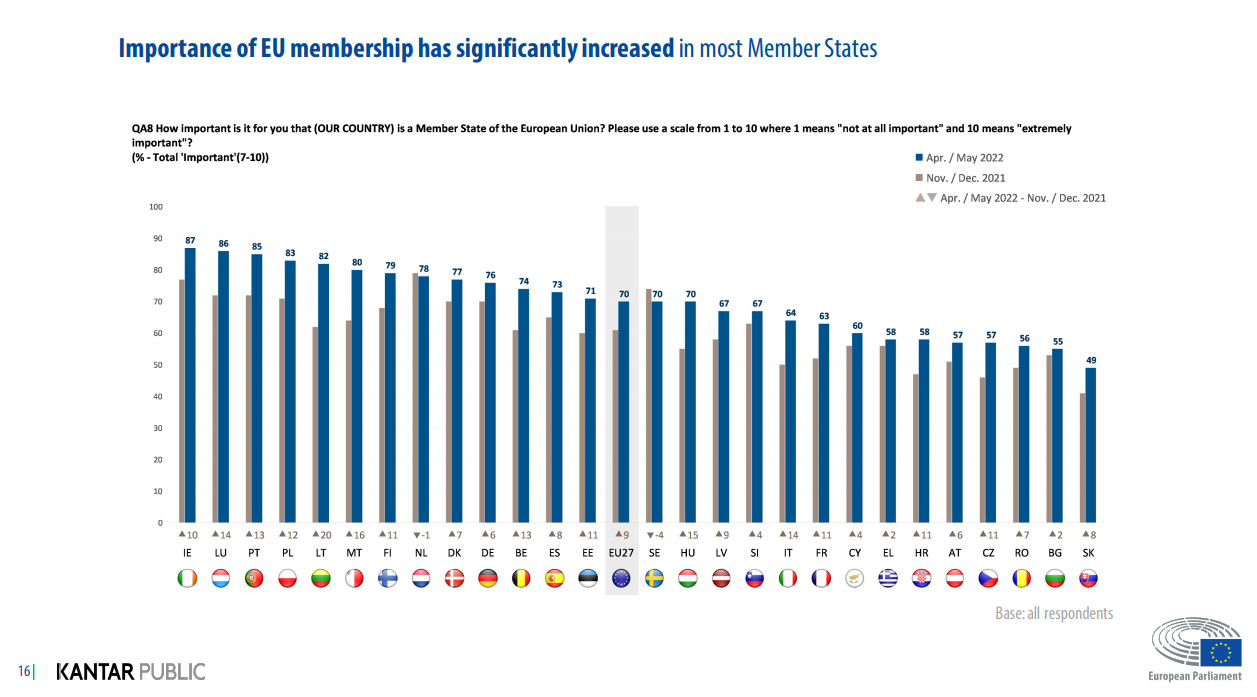

It is clear that for the moment that the market is not pricing a total crisis in Italy and it is entirely possible that things will work out fine. The following slide from a presentation from the European Parliament shows the result of a survey done by KANTAR PUBLIC comparing the perception of the EU membership from Nov/Dec 2021 to Apr/May 2022.

If pretty much all countries saw an increase in the overall rating of the importance of being a member of the EU, the increase was most significant in Italy with 14 points leap higher to 64%.

In parallel, it seems that leaving the Eurozone (quite possibly the greatest possible risk coming out of any EZ country election for markets) is no longer a priority for the parties running for the September elections and thus the immediate risk for financial markets may no be as large as feared in the past.

To conclude, it seems that the market has started to price a premium for the risk associated with the Italian elections. Given the summer period, it is also possible that the focus will increase around the start of September as the market is currently focused on other issues. In any case, Italian politics remain an important component of European politics and might influence the overall attitude of the bloc.