Last Week’s Highlights at IVolLive:

- Don't forget to register for our next live webinar on Tuesday, July 11th 2023 Webinar Topic: Options Profit and Loss Calculator on IVolLive HERE

- Get a free IVolLive Trial HERE.

Not So Fast Interest Rates...

June 29, 2023

What's Happening Now in the Markets

Federal Reserve Chairman Jerome Powell has a way of playing with investor's emotions...

After pausing interest rate hikes at the last FOMC meeting, Powell mentioned this week that the Fed may not be done raising rates just yet as he continues to eye inflation figures.

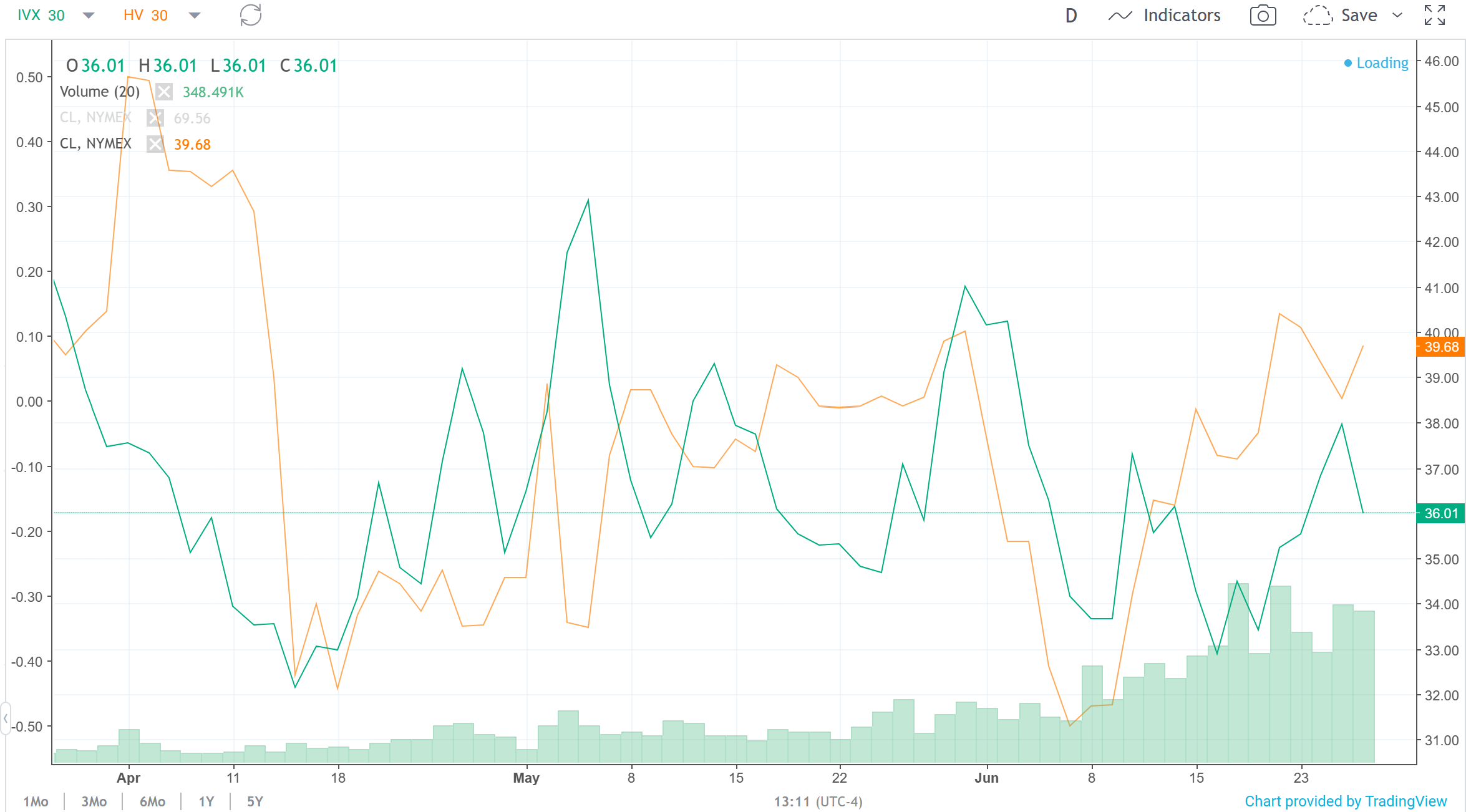

Zooming out to the market, oil futures bounced yesterday, recovering earlier losses from the week. The yield on the 10-year Treasury Note fell while the dollar strengthened against the euro, pound, and yen.

On a micro level, cruise line operators Carnival (CCL) and Norwegian (NCLH) rose as strong travel demand post-COVID continues to be a strong tailwind for the companies. This dovetails well with the narrative we've explained in past issues - that undervalued travel names remain interesting trading opportunities:

Also dovetailing with our recent writings warning about the AI chip sector being overheated... NVIDIA (NVDA) and AMD (AMD) have come under pressure this week as the U.S. government announced the potential for restricting exports of AI chips to China under natural security concerns.

Panning over to another ongoing seismic trend, EV automakers have performed well this week, led by market leader Tesla (TSLA) and followed by Lucid Group (LCID).

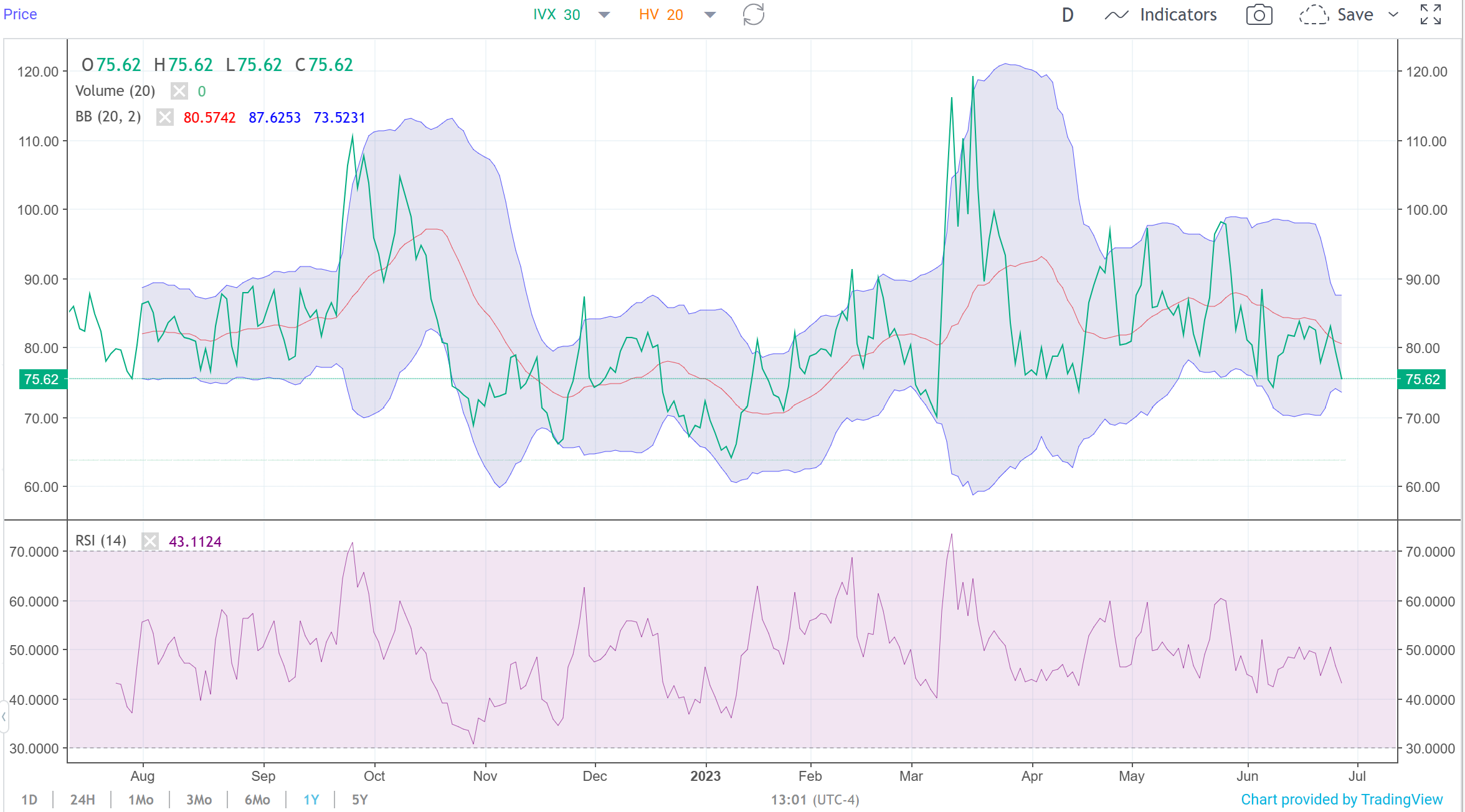

The market's fear gauge, the VIX, remains very low... hovering below 15 as we go to press. This signals extreme calm and complacency from investors:

In the chart above, we've isolated the implied volatility for the VIX. As you can see, it's traveling down towards the lower end of the Bollinger Bands and RSI. Once we hit extreme lows, we'll know the VIX is likely to rise.

And since a rising VIX corresponds with a falling market, that will help us time our trades.

How to Play It

With the VIX still so low, option prices are cheap. This means it's inexpensive to go long options on names you like (travel?), or to purchase cheap portfolio insurance (by buying puts).

This also means if you enjoy selling options, the premiums you would receive are lower than what they've been over the past year or so (meaning less income if you're selling puts or spreads).

Previous issues are located under the News tab on our website.