Last Week’s Highlights at IVolLive:

- On Tuesday, we had one of our best live webinars in recent weeks. In the webinar, we demonstrated how powerful the Options Probability calculators are, and how to use these powerful analytical tools to help traders craft actionable option trades. We saw some great potential long/short calls and puts, as well as spread trades like Straddles and Strangles.

- You can view an encore replay/recording of Tuesday's webinar HERE.

Also, since we mentioned spreads throughout the webinar, we've copied the webinar series on the Real Time Spread Scanner below:

The Four-Letter Word: NVDA

August 24, 2023

The most anticipated earnings event of the season happened yesterday after market close...

It's no secret that artificial intelligence (AI) has been the megatrend of 2023. Powered by excitement and momentum around the space, many tech names associated with the trend have soared the first half of this year.

And the 800-lbs gorilla in this space is Nvidia (NVDA).

This is why the market had been waiting with bated breath for the tech giant's earnings after the bell yesterday. The key question: is the AI trend still in full swing, or has it cooled off.

After all, NVDA had already risen 220%+ on the year. That's a meteoric move, especially for a firm of NVDA's size.

Essentially the question boiled down to: is the run up in the stock all sizzle, or is there a real juicy steak investors can bit into.

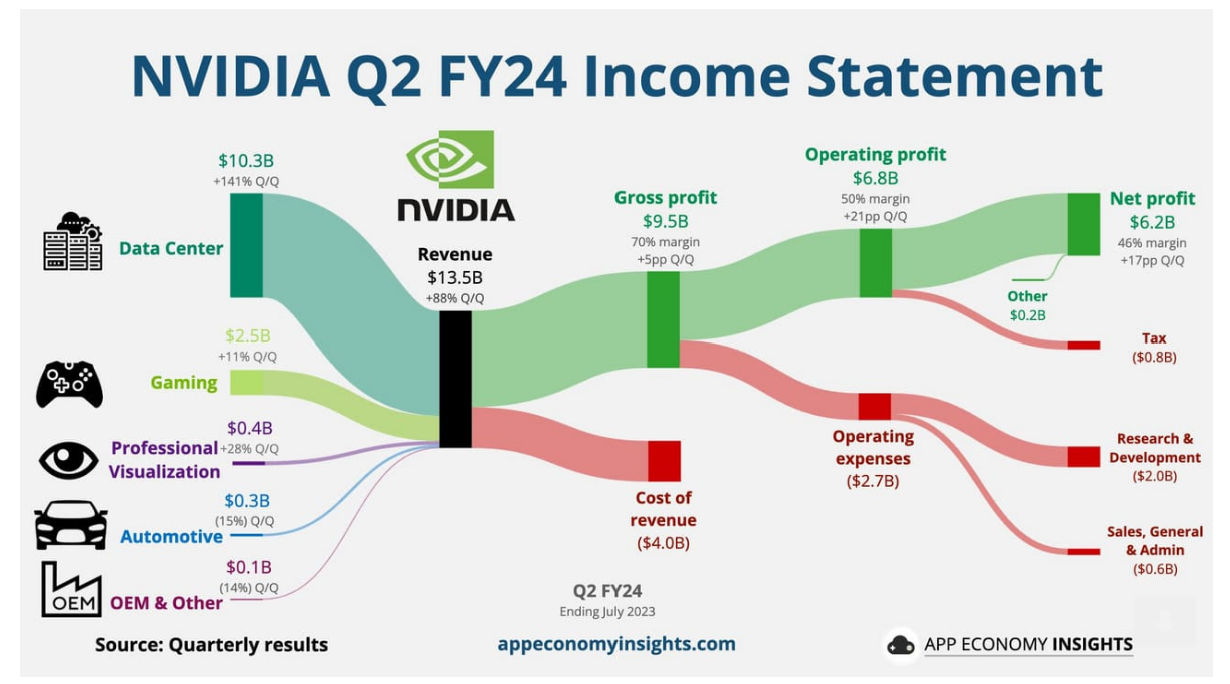

Well, NVDA answered that question by not just beating Wall Street estimates, but crushing them:

Summary: Revenue and profits surged 30% and 21%, respectively, as fellow tech companies (aka NVDA's customers) rushed to position themselves to cash in on AI.

Its data center group enjoyed record revenue, surging 171% year-over-year. Importantly - and Wall Street's favorite - NVDA projected for the growth to continue, predicting $15.7 billion in revenue for the quarter, well ahead of the $12.6 billion analysts had pegged.

How to Play It

Now, earnings are in the past, even if just by a day. To see what can happen in the future, we turn to IVolLive.

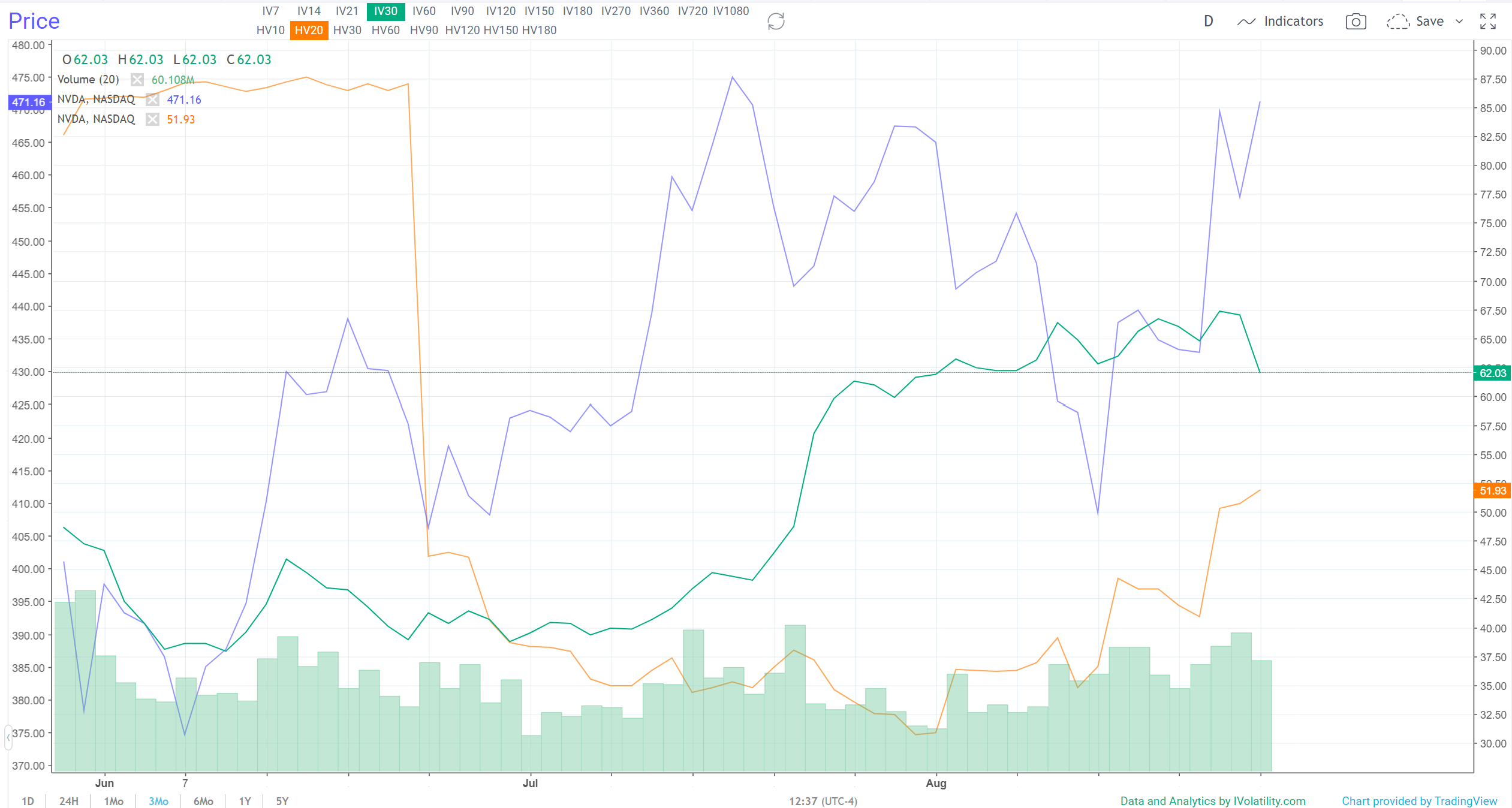

Here's a three-month chart showing NVDA's price (blue line), Implied Volatility (green line) and Historical Volatility (orange line):

As you can see, after releasing earnings, NVDA has resumed its uptrend, and its implied volatility is dropping. This means options are getting cheaper.

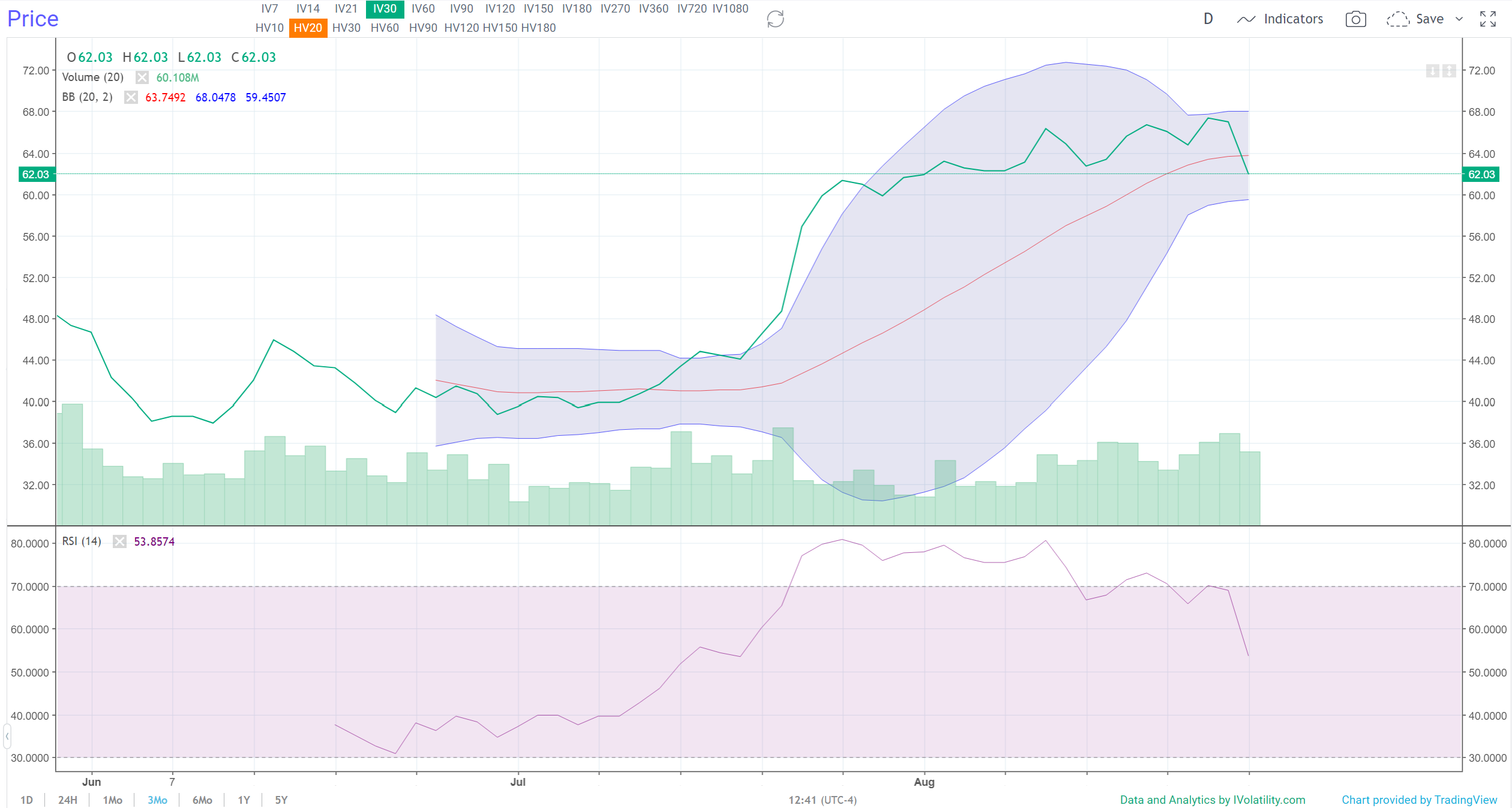

Also, when we isolate NVDA's implied volatility and apply two of our favorite technical indicators (Bollinger Bands and the RSI), we can see that implied volatility isn't at an extreme either:

This means the trend (up) can continue, is not in danger of an immediate reversal, and that option prices are cheaper now than they were before earnings.

Translation: for traders interested in going long (bullish) on NVDA, now could be a good time.

Previous issues are located under the News tab on our website.