Last Week’s Highlights at IVolLive:

- Don't forget to register for our next live webinar on Tuesday, October 5th 2023 Webinar Topic: Learn how to analyze the potential profit and potential loss for puts, calls, and option spread trades HERE

- Get a free IVolLive Trial HERE.

The Little Guys Play Catch Up...

September 29, 2023

As we've written in these pages, the summer was a rough one for the market. Low volume combined with lackluster price action led to a gradual seepage in stock prices.

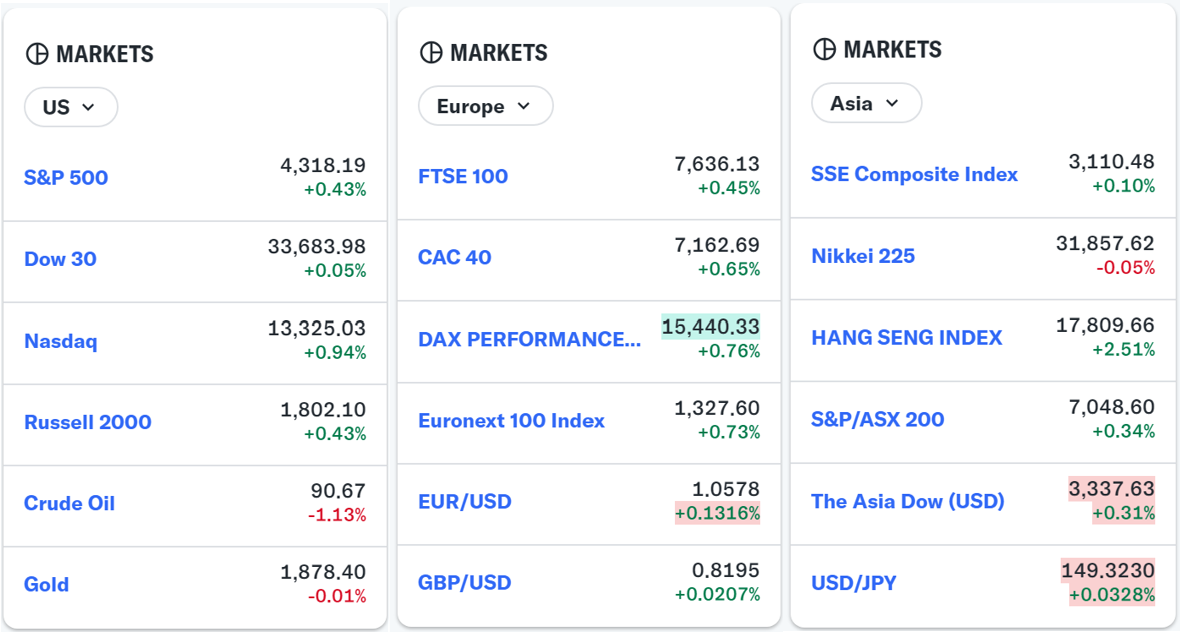

That said, the S&P 500 is still up 14%. The Russell 2000 (IWM) on the other hand (which contains smaller companies) is only up 2% after a rough September. Indeed, last week IWM fell six days in arow - that's the longest consecutive streak for the index in over a year.

Smaller companies are typically more volatile. They have higher upside... and downside. However, after such poor price action, the question becomes: could now be a good time to nibble on smallcaps?

For that, we turn to our handy compass: IVolLive:

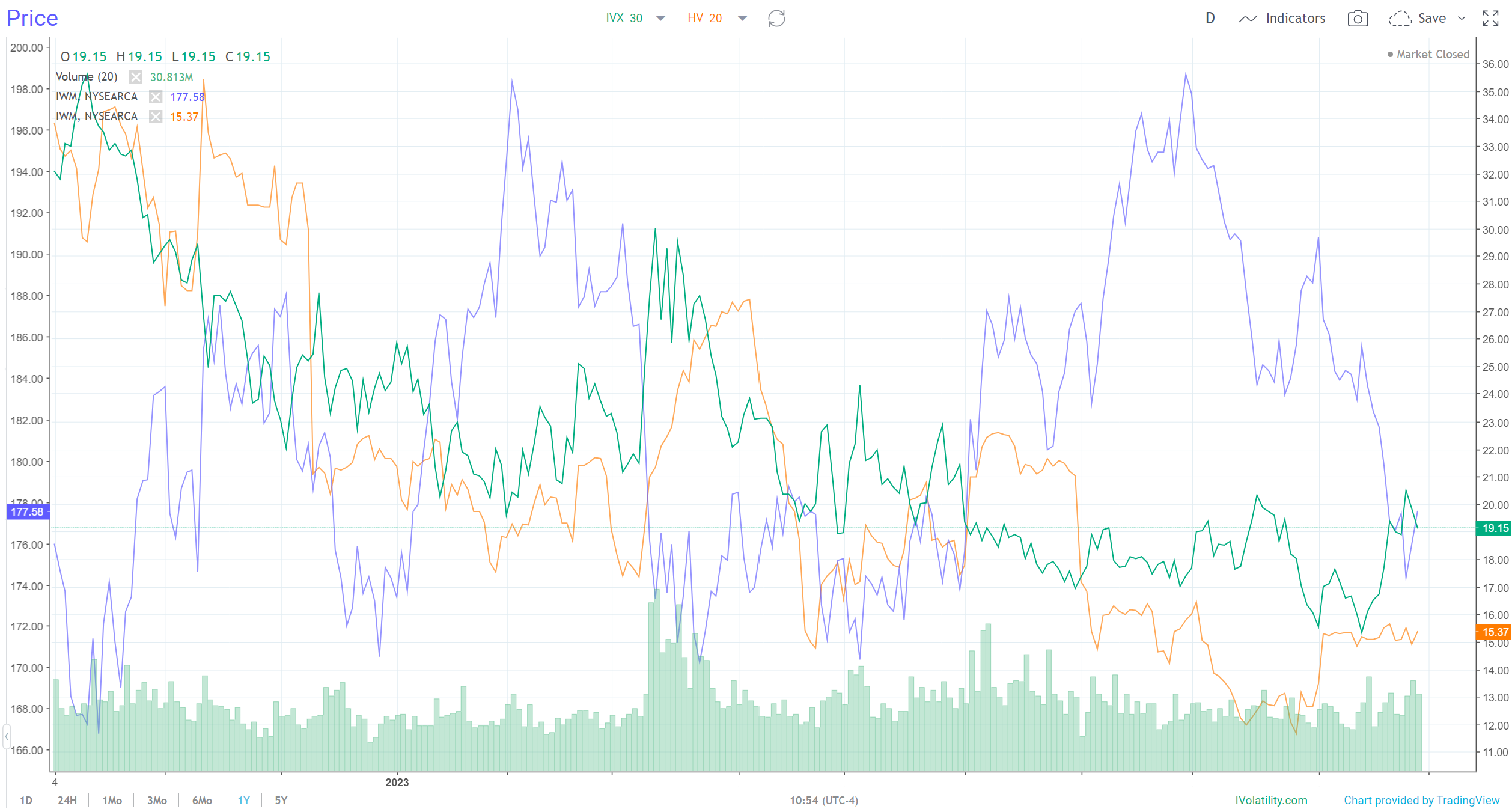

As we can see in this one-year chart above, IWM's share price (blue line) and Implied Volatility (IV-green line) have just met twice, or "double kissed".

This is actually one of our favorite trade setups. It means that IV is elevated, while at the same time, the dramatic drop in share price has paused. This can be an excellent time to sell options.

Here's why...

With elevated IV, option premiums will be relatively large. So, by selling options, one would maximize her income. Also, after such a dramatic drop in a major index - like IWM - a reversal eventually comes. And share price <> IV meeting ("kissing") is often the precursor to this signal.

Savvy traders could look to use our IVolLive charts and technical analysis tools to time potential entries into the trade… and the IVolLive Options Chian, Probability Calculator, and P&L Calculator to evaluate potential trades.

Savvy traders could look to use our IVolLive charts and technical analysis tools to time potential entries into the trade... and the IVolLive Options Chian, Probability Calculator, and P&L Calculator to evaluate potential trades.

(You can watch a recap of our Charts and Technical Analysis webinar from Tuesday HERE, where we use Exxon, Cisco, and Walgreens as examples.)

How to Play It

Smallcap stocks have suffered a vicious selloff. They are severely lagging and underperforming their large cap peers.

However, with implied volatility and share price performing a double kiss, now could be an interesting entry point for savvy options traders.

While the acquisition of Splunk is large - and there are bound to be complications along the way - the bottom line is that Cisco has nearly $30B in cash on its balance sheet, a stellar credit rating, and generates billions in net profits and cash flow every year.

While the road to closing this deal could be a rocky one, that will create plenty of trading opportunities for savvy traders along the way. And when the share price and implied volatility "kiss", that can be a good sign to strike...

Previous issues are located under the News tab on our website.