Trading the Downside vs. the "Non-Upside"

March 7, 2024

The Markets at a Glance

QQQ

Despite some sharp upmoves resulting from earnings announcements in stocks such as Target (TGT) and Crowdstrike (CRWD), an unusual spurt of selling took the major indexes down on Tuesday (3/5), raising once again the question of whether the rally from October was getting ready to roll over. The QQQ (which led the rally and is often considered the bellwether that determines when the rally will end as well) was down 1.8%. There was only one other day since last October that a decline of that size occurred on a single day.

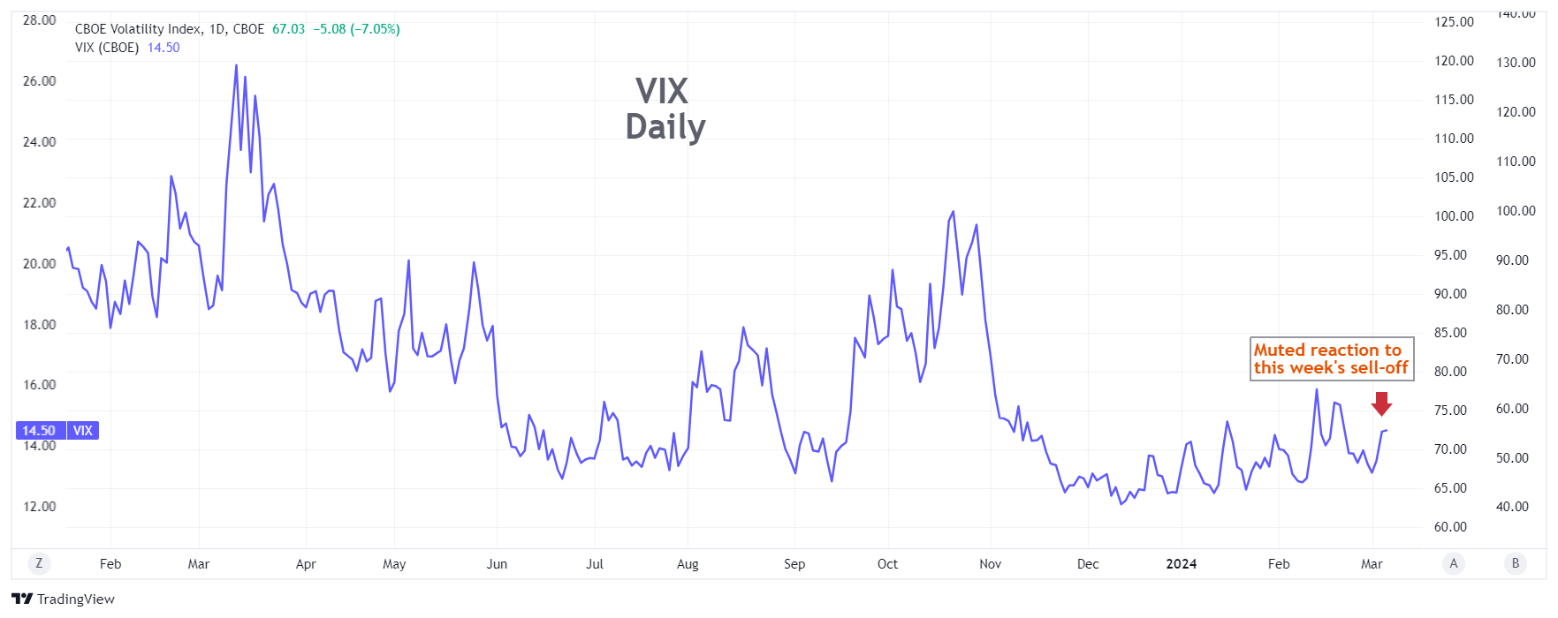

Looking at the VIX index, implied volatility on the S&P 500 moved up only slightly but did not make a dramatic leap upward by any stretch and remains below the highest levels from February. This suggests that the decline in SPY and QQQ did not send institutions running to purchase put options - at least not yet.

So, we have what could be the beginning of a correction but is not sufficient yet to warrant traders buying puts yet either. This brings up the subject of today's strategy talk: option strategies for playing the downside vs. strategies for playing a "non-upside".

Strategy talk: Trading the Downside vs. the "Non-Upside"

Anticipating trend changes is an activity that tempts traders as it offers the ability to capture potentially above-average trading profits somewhat quickly, avoid the trading losses that trend followers face when a trend ends, and provides a certain personal satisfaction that comes from outsmarting the crowd.

But calling trend changes is highly challenging and very few people can do it consistently. Buying puts in anticipation of the end of a rally can prove quite costly if the rally continues. Incorrectly anticipating a turn several times not only loses more money but can cause the trader to feel the need to “get evenâ€