Hedging with VIX Calls Instead of SPY Puts

June 7, 2024

The Markets at a Glance

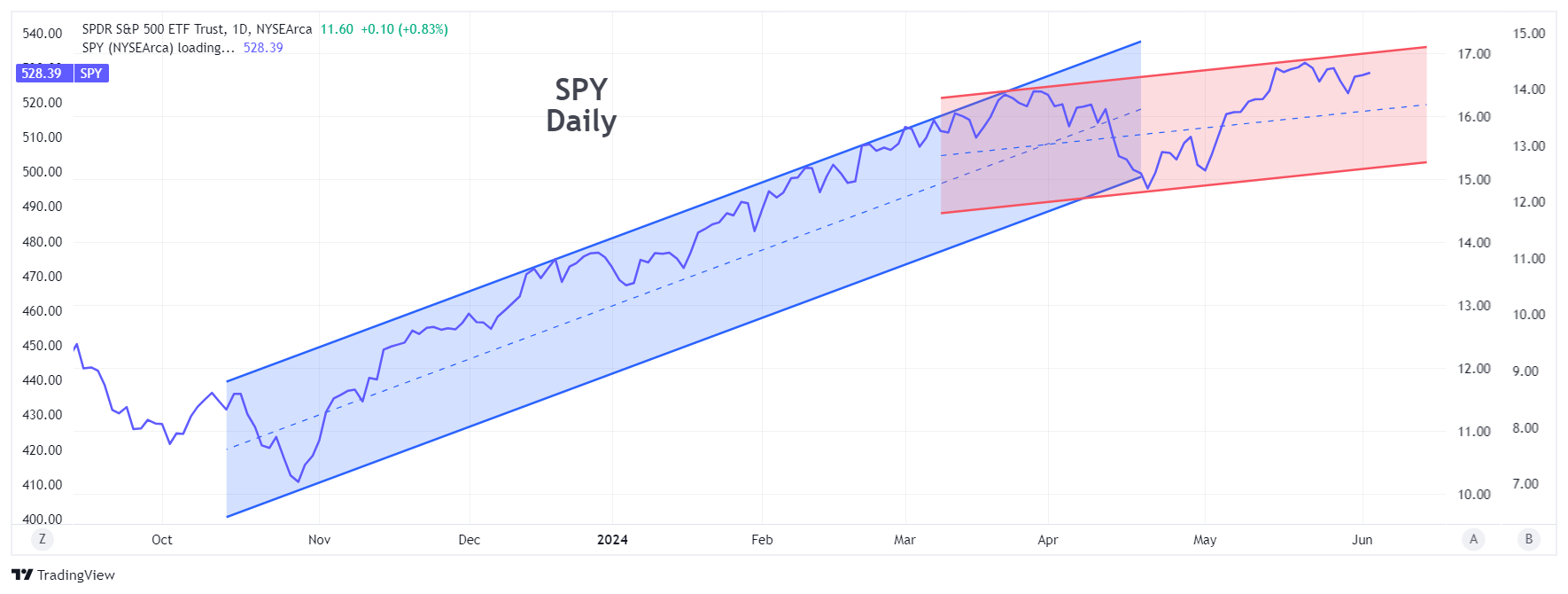

The path of least resistance for the market continues to be up, as SPY and QQQ both set new highs again in June. Apparently, the slight softness in jobs data is insufficient to cause much concern and the expectation is that inflation is also tempering. This may be all the market needs to keep alive the hope of a rate cut or two later this year.

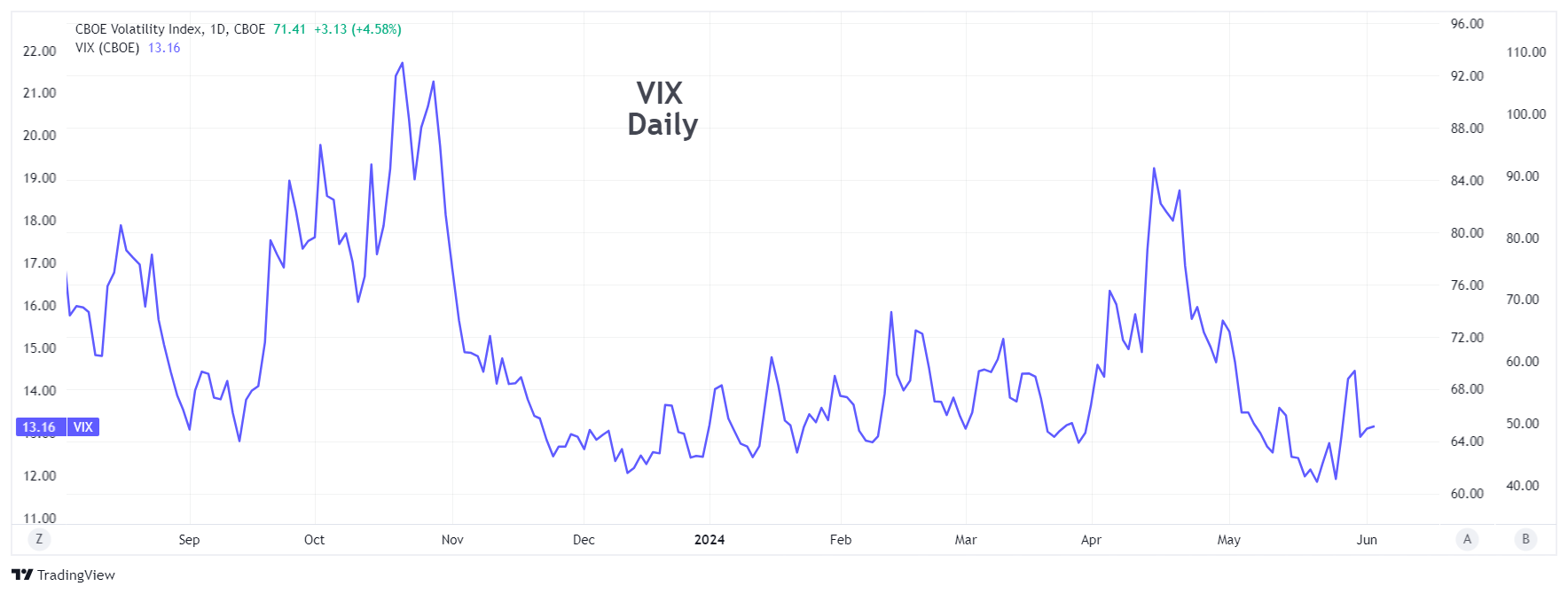

Meanwhile, implied volatility backed off from its recent spike to 14.59 and is back at 12.63 as of Wednesday's close, quickly reacting to the market's strong first week in June.

Additional bullish sentiments were echoed by two sources that I noted this week. First, Bloomberg ran an article saying that Goldman Sachs expects "a wall of money" to enter the market in July, noting that the first 15 days of the month are part of a seasonal trend upward.

The second bullish note came from options expert Larry MacMillan, who pointed out in his newsletter that the neutral-to-bearish tone of the "Sell in May and go away" adage tends not to be the case when the market sets a new high in May, which it did, and that the year tends to continue upward when that occurs.

That said, I am personally still keeping an eye out for a correction, even if only minor, given that the market is hitting the higher boundary of its current uptrend.

Strategy talk: Hedging with VIX Calls Instead of SPY Puts

If you agree with the bullish forecasts and are thinking about going (or remaining) long here for further upside but are concerned about geopolitical or other potentially market-moving events, you may want to look into a hedging strategy that traders often use as an alternative to purchasing long puts on a market index -- purchasing VIX calls instead.

A VIX hedge can be implemented any time you are trying to hedge a broad market portfolio, or if you want to just put on a hedged bullish strategy with options when conditions look right for it. In that case, you would purchase a long call on SPY combined with a long call on VIX. The strategy is used often enough that the CBOE tracks an index on it called the VIX Tail Hedge Index (VXTH).

With VIX at low levels, long VIX calls are relatively cheap. However, the same could be said about SPY puts themselves, since the VIX is a measure of the implied volatility in SPY options. So, long puts or put spreads on SPY can hedge the downside and a collar can reduce the cost even more. But a viable alternative is a VIX tail hedge using long calls, bull spreads, or even back spreads (selling 1 ATM call and buying 2 OTM calls).

For traders who have experienced the pain of watching time value erode on protective puts, the VIX tail hedge can offer advantages. Puts on an index that is at a price in the mid-500s are going to require a lot of capital. Calls on an index that is at 12-13 will require much less. And volatility can result in a significant spike upward even when an index has only just begun to drop, allowing the trader to potentially offset portfolio losses earlier.

In addition, VIX calls generally have good liquidity, and that liquidity will likely improve in a crisis. VIX can also react quickly and a VIX spike can potentially return multiples of its original cost.

The only thing to remember, if looking to purchase VIX calls for later this year is the election, which has already created a bulge in the price of October VIX options.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.