Rolling Covered Calls

July 8, 2024

The Markets at a Glance

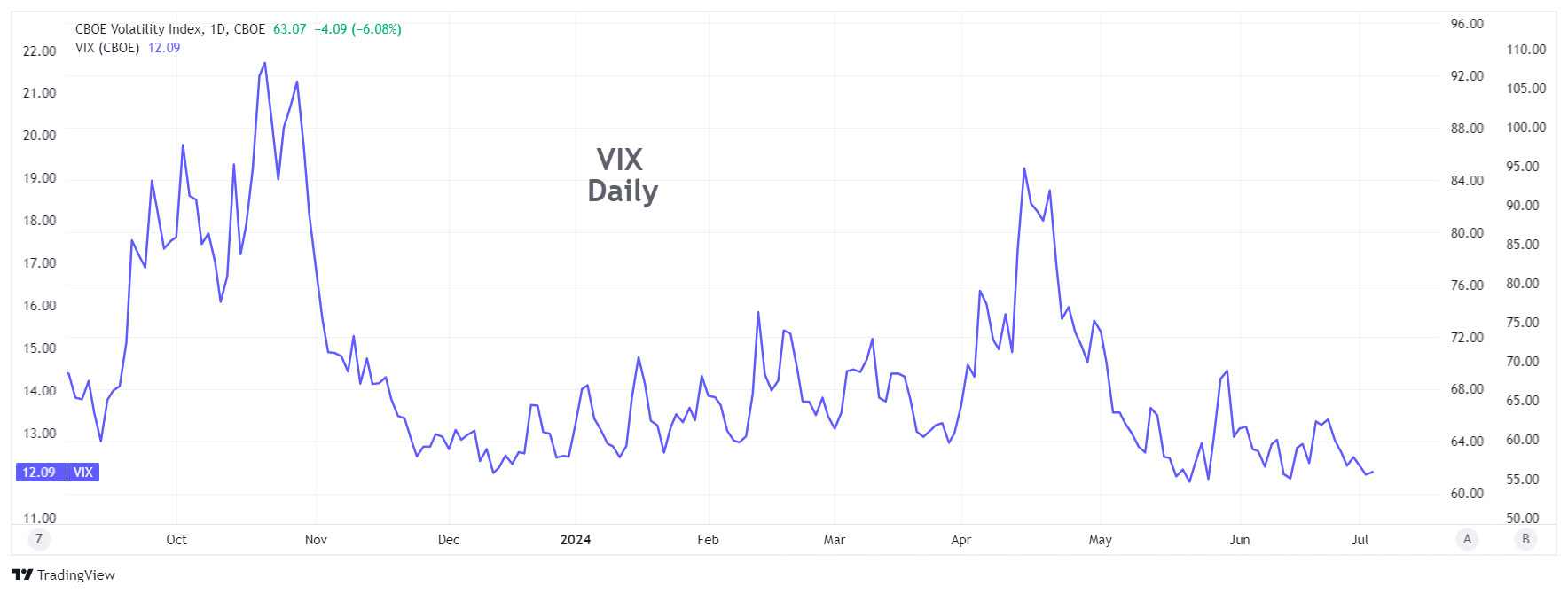

In a shortened week, the overall picture has not changed. SPY hit another new high and VIX sunk to the low 12s. And while Nvidia (NVDA) remains almost 10% below its mid-June peak, that did not deter the Technology Sector ETF (XLK) from hitting a new high this week also.

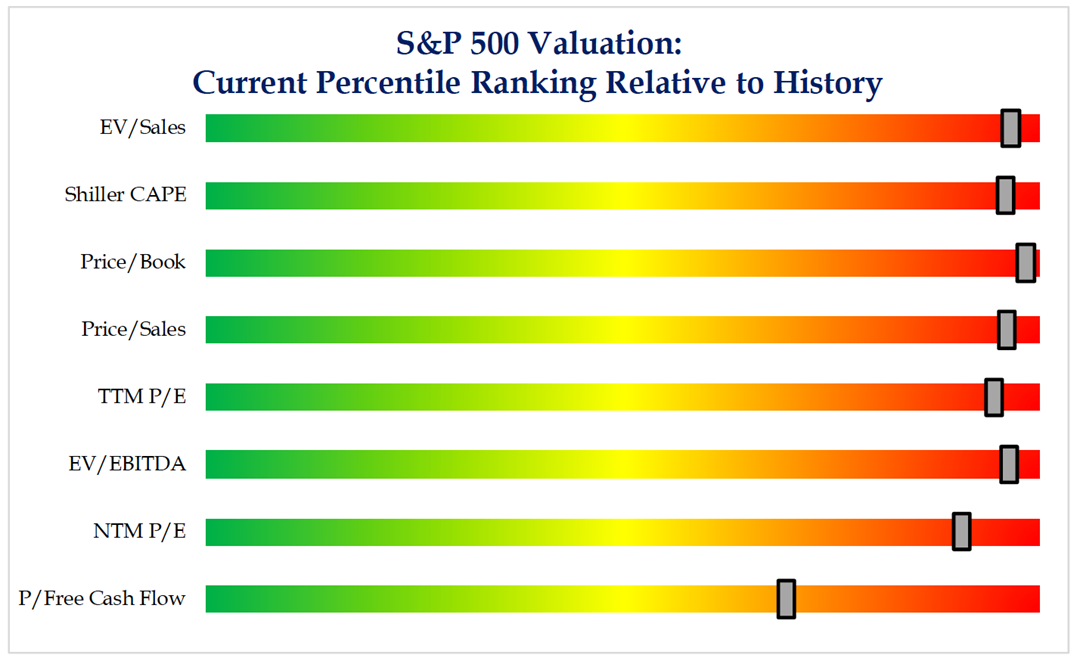

I've been showing the S&P 500 equal weight index (RSP) as lagging the cap-weighted version (SPY) to demonstrate the disparity between the top performers this year and the rank and file. This week, I'm including a graphic that shows where the S&P 500 is relative to its own history, in terms of various key ratios.

Now, seasoned traders know that markets can run hot for an extended period of time, so these ratios are a warning, but not necessarily an immediate one. We just don't know when things will turn or what the catalyst will be. But it does make sense to hedge our bets a little, as a correction of some sort is a matter of 'when', not 'if'.

NVDA dropped from 140 to 118 in a week. Massive up moves have a way of tempting even the hardiest of holders with a little profit-taking. But profits on stocks that have had exceptional gains are often just redeployed to long positions elsewhere as a rally broadens out. So, it is good to be on alert for specific stocks to correct if they are overextended, but not to assume that the broader market rally is ending just because a few stocks falter.

Strategy talk: Rolling Covered Calls

As stocks extend their rallies, covered call writers can find themselves with positions that are now in-the-money. While that means the net position is gaining value, people have a natural tendency to get anxious about it if taking a loss on the call or being called away on the stock are undesirable outcomes, particularly when being called away would trigger a large taxable gain.

Ironically, such a scenario means the underlying stock has gone up more than expected, which is actually good news, and a covered call cannot go up in price more than the underlying stock, so the covered writer is making a net profit on the position from the price when the call was originally written. But losses loom large in people's minds and loss aversion can cause high anxiety or even mild panic when covered calls go in-the-money.

Rolling covered calls (i.e. closing them and writing new ones at the same time) thus often becomes a tactic that is implemented under emotional distress at the expense of sound logic. Here are some things to remember when covered calls go in-the-money.

- Important - While calls can technically be exercised any time prior to expiration, it is not in a holder's best interest to do so while there is still any time value in the option. (That's because as long as there is time value left in the option, it will always be better to sell the option rather than exercise it.) Even when options are in-the-money, they still retain lots of time value. Time value will generally only disappear when an option is very deep in the money and/or very close (within days) of expiration. Therefore, the fact that an option has become in-the-money should not, by itself, be reason for a covered writer to believe they will imminently be assigned.

- Rolling may or may not result in talking a loss on the calls that are being closed. Taking a loss can be disconcerting to a writer, but it should be remembered that the stock will have gained more than the option has lost, so the writer is still better off than they were when they originally sold the calls. They might have made even more by not selling calls, but they could not have lost money by writing calls - only lost an opportunity to have made more.

- Writers have lots of flexibility when rolling. They can roll up to a higher strike in the same expiration or to a different strike in a more distant expiration. Also, writers do not need to write all calls at the same strike either way.

- Rolling can often be executed for a credit - where the new calls will bring in more cash than the current calls cost to close. That's great, but should not be viewed as a mandate. If a stock is doing very well, a writer may want to sell calls at a much higher strike when rolling and may not be able to obtain a credit. The writer needs to balance the desire for a credit on the roll versus the upside potential on the stock.

- There is no absolute rule about rolling. It is a balance between taking in premium, giving the stock room for upside growth, maintaining downside protection, and how much time the writer wants to wait until expiration. Before rolling, a writer should consider the alternatives carefully.

- Writers should remember that while writing a more distant call brings in more premium income, it does not bring in proportionately more income to the extra time. Because time value decay accelerates closer to expiration, writing shorter duration calls more frequently can yield more income over time than writing a single longer duration call. (Example: Writing a call each month brings in more premium over six months than writing a six-month call in the first place. Also, writing shorter duration calls provides much more rolling flexibility.)

- In general, having a covered call go in-the-money is a good problem to have - it means you made money overall, even if you are losing money on the option. Traders should focus on that fact and not the loss on the option in order to make sound judgments on whether to roll.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.