The Beauty of Calendar Spreads

September 6, 2024

The Markets at a Glance

It seems pretty clear that the SPY is not yet ready to set new highs until it reckons with the anticipated rate cut, the latest economic numbers, the election, and the seasonal weakness. The biggest of these question marks (or at least the one most likely to be concerned about) is the economy.

One has to admit that by July, the market was pricing in a scenario that was filled with optimism not only for an ease in inflation, but a rate cut (or two or three) and a perfectly soft landing for the economy in the process. The highs in July were thus the result of nearly ten months of complacency coupled with the excitement of AI possibly ushering in a whole new cycle of tech innovation.

The August swoon was simply the job numbers taking some air out of the complacency balloon. when a market (or an individual stock like NVDA) is priced for perfection, there can often be hard, fast wake-up call if even some investors get spooked.

The resulting swoon in August was quickly recovered, but here we are again, and one cannot help but feel that with a bit more softness in the economy and the normal malaise that often accompanies Septembers and Octobers, the market is itching to take a breather.

You know people are spooked when they begin saying that a half-point cut in rates will be bad news as it will signal that the Fed is more concerned about weakness now than in inflation previously.

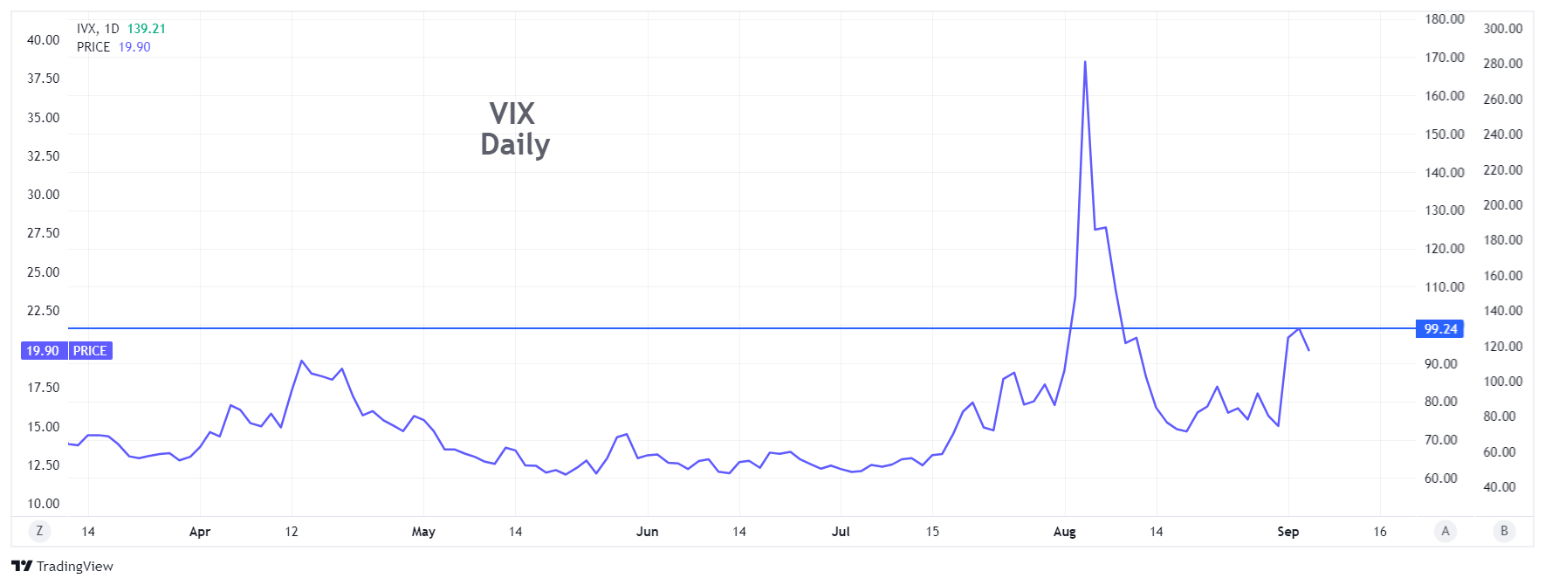

The evidence is also largely pointing to further market weakness in the near term: bullish action in defensive plays like utilities and T-bonds; lack of leadership from the previous power stocks; small caps also seeing a possible double-top; and well above average VIX. The good news is that the seasonal weakness gives way to end of year strength in November through January, so a dip now could provide some very attractive entry points for new positions.

Strategy talk: Calendar Spreads - Their Beauty is in What You Can Build With Them

A plain vanilla calendar spread is a questionable strategy, seldom used in its basic form. That's because the basic definition of a calendar spread is simply the purchase of a longer-dated option coupled with the sale of a short-dated option on the same stock at the same strike price. The logic of the strategy is to profit as the spread widens, which will tend to happen as the time value of the long position decays more slowly than the short.

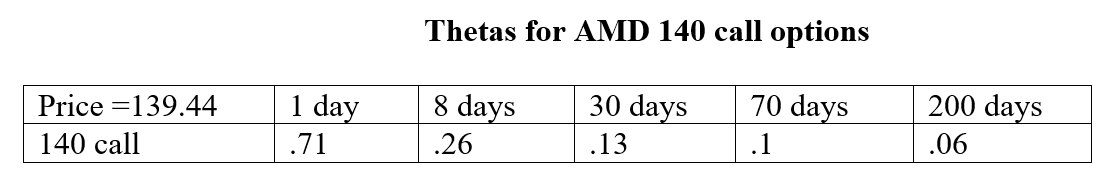

Remembering that time decay occurs more rapidly as expiration approaches, it would seem that such a strategy when implemented on a neutral basis (using an ATM strike), should be a somewhat consistent winner.

Here's an example using AMD options to show the difference in theta (the theoretical amount of value an option will change due to a one-day passage in time).

Actually, it can be - just not in its plain vanilla form.

There are two primary reasons why the basic strategy doesn't shine:

- To benefit from the difference in time decay, you want a lot of time value to begin with. That means keeping the strategy neutral (or as neutral as possible, anyway) by using an ATM strike for both options. ATM strikes are good for option sellers as they carry the most time value of any strike price. But they are bad for option buyers for the same reason, and the disadvantage gets worse the longer you hold them.

- Stocks don't sit still. So, what is intended to be a non-directional strategy turns out to be directional anyway, and a move in the wrong direction can lose more in intrinsic value than it makes on time decay. You can even lose money if the stock moves too much in the right direction.

However, the principle of faster time decay on expiring options is a core aspect of numerous option strategies (including the Zero DTE strategy I discussed last week.)

So, two ways to improve the basic calendar spread are as follows:

- Make the calendar into a diagonal, where the longer dated option is ITM. That will also make it directional to the upside, but in a market that is trending upward, you would want that anyway. A diagonal call spread (buying say an ITM call about 1-2 months in duration and selling an ATM or OTM call for a few days to a week or so) is really the same strategy as a covered call write, but with more leverage since the long call costs way less than the stock.

- Put on two calendar spreads together, one with calls and one with puts, using the same strikes for both. This does tend to neutralize the direction and gives a wider range of prices in which to make a profit, though introduces short term risks in both directions should there be an outsized move in the near term.

Essentially this latter strategy creates two straddles - a long straddle in the more distant expiration and a short straddle in the close expiration. This can be an interesting strategy when there is a volatility skew giving you much higher IVs on the near-term straddle and lower (or more normal) IVs on the longer-term straddle.

The point is that faster time decay for shorter-term options is a core aspect of how professional option traders make money. It may not be optimized with a plain vanilla calendar spread but it is a critical component to many other option strategies and one of the most reliable factors in option theory.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.