Is it Ever a Good Idea to "Catch a Falling Knife"?

October 3, 2024

The Markets at a Glance

After standing its ground for a few days following last week's rate cut, the weight of major events finally began to pull the major indexes (SPY, QQQ, IWM) slightly downward. The drops were benign thus far, however, having no effect at all on the longer uptrend.

The minor drop likely reflects the mixed influences of several recent events that occurred in the last week - most notably the speech by Fed Chairman Powell, the dockworkers strike, and the missile attack on Israel by Iran following Israel's incursion into Lebanon.

While Powell's remarks provided positive reinforcement on the health of the economy coupled with intentions toward future rate cuts, that news was largely affirming and therefore largely already incorporated into current valuations. On the other hand, the strike and the middle east escalation present new uncertainties that could become worse as they develop, causing concerns that appear to have outweighed economic optimism at the moment.

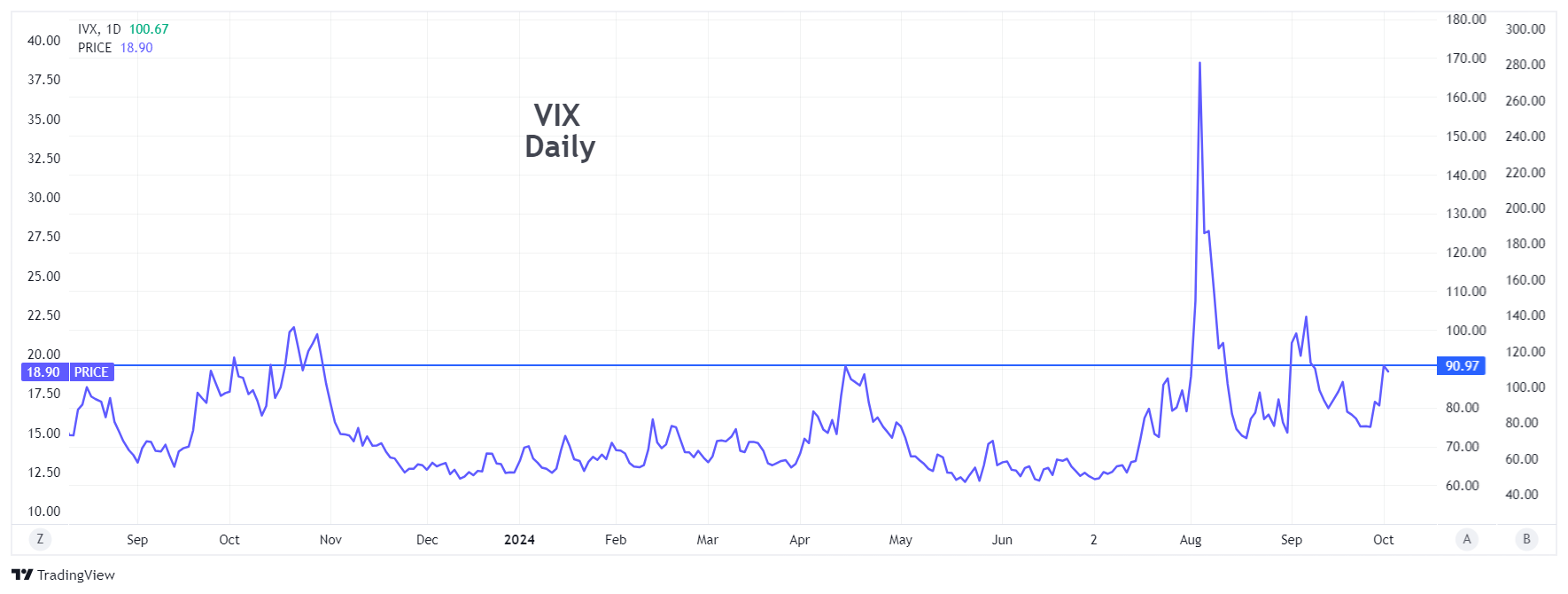

These concerns were evident in the VIX, which spiked above 20 and is still hovering near 19. That is likely sufficient for traders who purchased ITM VIX options last week to have a profit already, in keeping with the strategy I mentioned in last week's newsletter about buying ITM VIX options for shorter periods and smaller VIX spikes, as opposed to buying longer-dated OTM VIX options to hedge more substantial tail risk.

My take here is that the market is rather fully valued for the current state of the economy and that while action between the election and year-end could still see new highs if conditions are favorable, there are wildcards that could easily lead to sharp sell-offs over for the next month or so. As a result, volatility levels continue to be generally favorable for option writers.

Strategy Talk: "Catching a Falling Knife"

Here's a question: When looking for a short-term trading opportunity, is it better to buy a stock that just moved higher on good news, or one that just sold off on bad news?

I don't have a hard statistical answer for that, but I can tell you that buying dips has two advantages. It combines buying the stock at a lower-than-normal price with selling call options that are likely trading at a higher-than-normal price.

Buying dips, however, especially when falling sharply is obviously risky and has been aptly characterized as trying to "catch a falling knife". Doing so is not for the faint at heart.

But from my experience, it is an attractive strategy under the right circumstances.

I learned an expensive lesson on the practice very early in my career when Lehman Brothers (no relation) went bankrupt. Bear Stearns quickly dropped from the 60s to the low 20s following the news on Lehman. Figuring that Bear Stearns was merely in a 'sympathy sell-off', I bought calls at the 20 strike. A few days later, the stock was 2.

I made two big (and expensive) errors with that move:

- I made an uninformed guess on why the stock was down.

- I bought calls.

Decades later, I occasionally employ a 'falling knife' strategy with far better results. Here's my advice on the strategy, should the opportunity arise:

- First, the strategy should never be to simply buy a call. Rapidly falling stocks will typically reflect very high implied volatility and a long call position will thus be overpriced. That provides a substantial headwind to the strategy as the volatility subsides and reduces the time value in the call. Consequently, you can be correct about direction and still lose money on your trade.

- Therefore, selling puts or implementing covered calls is the much-preferred approach.

- Be confident that the stock decline is some sort of overreaction and not the result of a significant new development that could warrant a much lower price. If you are unsure, it may be best to stand aside.

- Do not be so over-confident that you believe you can pick the exact bottom. No one can.

- Stay short term - days to maybe a week or two.

- Use ATM or even ITM calls on covered writes. That way you err on the side of having greater downside protection as opposed to hoping for a significant rebound.

- Focus on quality stocks or indexes.

- Try a few on paper first to see how they work.

If you play with stocks that have questionable fundamentals to begin with, you have much greater risk. It's better to work with quality stocks that will much more likely be purchased as they decline by people who missed them on the way up.

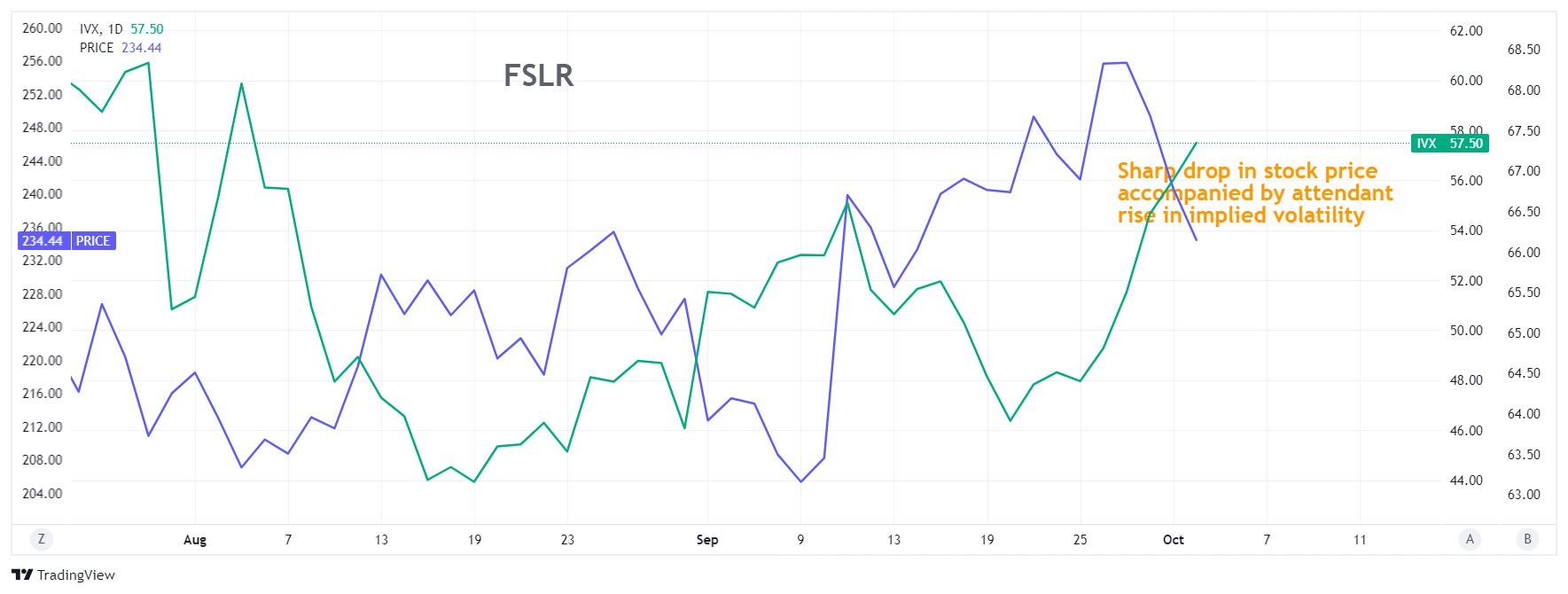

Example:FSLR (An example - not a recommendation!)

I like First Solar so I took a "falling knife" position in it on Wednesday. I bought the stock at 234.76, down from a high of 262.72 just a few days prior and down 6.2 on Wednesday. (Notice, the low today was 228.10 but it did not remain there for very long.)

I simultaneously sold the FSLR 232.50 call for 6 points expiring this Friday. My net cost was therefore 234.76 - 6 = 228.48 and my maximum gain on Friday, if assigned, will be 4.02 or 1.7% for two days. (If it doesn't sound like a lot, just imagine doing one of those every week.) Also, I could have written the 235 call instead for greater potential gain, but with less downside protection.

On Wednesday's close, the stock was 234.44 (a loss to me of $32.00). Meanwhile, the call was down even more, providing an $87 gain. Having time value work for you when implied volatility is high provides an attractive trade with reasonable downside protection. I may still lose money on the trade, but overall, some knives are dull enough to be caught while falling.

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the option strategies discussed in this newsletter. If there is something you would like us to address, we're always open to your suggestions. Use rhlehman@ivolatility.com.

Previous issues are located under the News tab on our website.