MBS Bonds Valuation - Is There an Alternative to "Black Box" Models?

April 07, 2025

The status quo in MBS bonds valuation relies on prepayment models built by some of the smartest mathematicians I know. These models are highly complex, as they attempt to describe a diverse $12 trillion mortgage universe using mathematical formulas and the subjective opinions of the modelers. While these models have achieved a great deal, they suffer from three inherent drawbacks:

- Accuracy – Mortgages are extremely diverse, and it is nearly impossible to describe all types of collateral using even the most sophisticated formulas. Given the complexity of mortgage loan behavior – where every loan is unique – these models are impressive, but their accuracy is often insufficient for many collateral subtypes.

- Lack of Transparency – These models are so intricate and have been developed by numerous contributors over many years, making it difficult to fully understand all the embedded interrelationships.

- Long Rollout Time Lag – When mortgage collateral performance changes, the models require recalibration and rollout, a process that typically takes months.

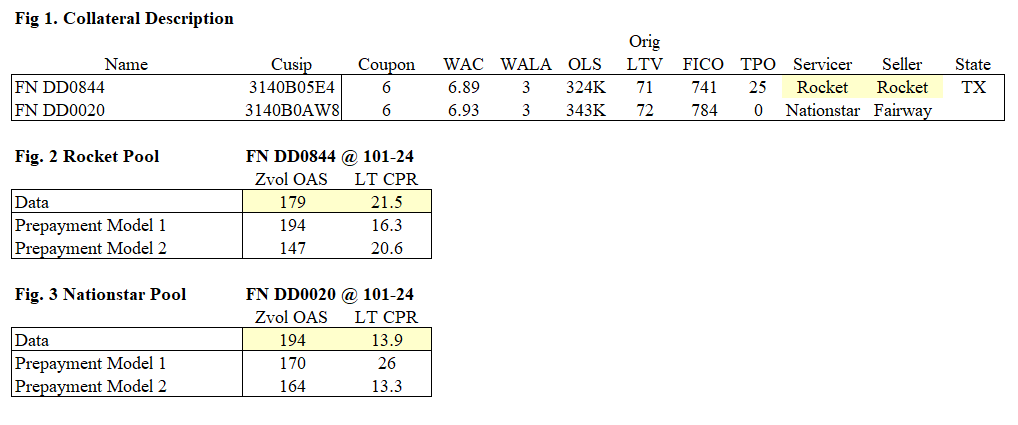

Instead of continuing with this theoretical discussion above, let's consider a practical example of valuing two MBS FN 6 pools: FN DD0844 (Serviced by Rocket) and FN DD0020 (Serviced by Nationstar). The characteristics of the collateral of these pools are shown in Fig. 1. Their valuations, using two leading prepayment models (so these results are easily replicable), are shown in Fig. 2 and Fig. 3. The results raise several questions:

- Prepayment Model 1 shows the Rocket pool as materially cheaper than the Nationstar pool, while Prepayment Model 2 shows the opposite.

- Prepayment Model 1 projects slower prepayments for Rocket, while Prepayment Model 2 shows faster prepayments.

- What collateral characteristics are treated differently by these models so that they get opposite results? Is it the servicer? FICO? Geography?

- A different version of the same model gives yet another result – how do we know which version is correct?

- Rocket just acquired Nationstar last week – can we afford to wait a few months for the models to reflect that?

- The market rallied 100bps vs. its January peak – can we wait a few months for the models to catch up with a likely shift in S-Curve?

- How can one replicate results of the prepayment models (ZVol OAS, DV01, Convexity, etc) intuitively using a standard MBS pricing screen?

It's all very complicated – but is there a better solution?

We believe there is – it's to automate what MBS traders already do manually – using the following two steps:

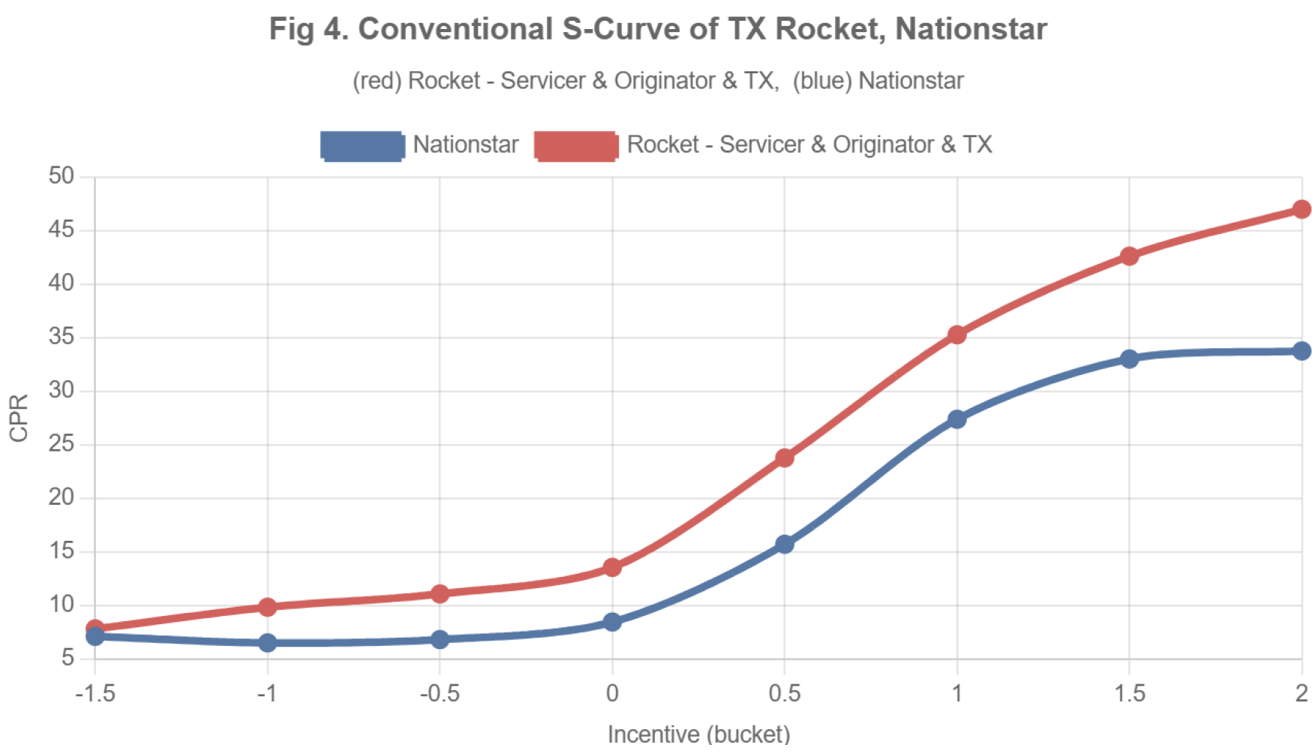

- For each bond, select similar collateral that backs it (see Fig. 4 for S-Curves for collateral similar to backing these bonds).

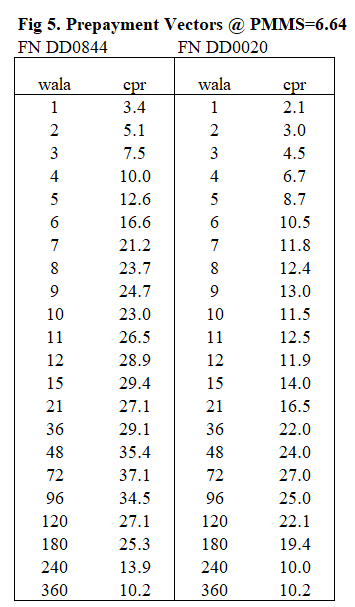

- Use the prepayment vectors derived from this similar collateral performance under similar market conditions (e.g., similar refinance incentive or seasoning) for the valuation.

The valuation results using this No-Model Data-Driven approach are shown in Fig. 2 and Fig. 3, under the "Data" row, based on Data-Driven prepayment vectors shown in Fig. 5. Here are the advantages of this approach:

- Accuracy – This approach captures all MBS sectors accurately as long as there's enough similar collateral data (which is usually not a problem in MBS, given its market's size).

- Transparency – The prepayment vector can be verified by querying loan-level data (we have UI tools for that). Pricing and risk can be validated using any MBS pricing screen by applying the vectors of Fig. 5. Even complex metrics like OAS or convexity can be calculated intuitively: see how.

- No Rollout Lag – Results update as soon as new prepayment reports are released.

Let us know if we can help in valuing your bonds using No-Model Data-Driven approach!

Why Choose Us?

With over 20 years of experience and a proven track record in data and analytics development, IVolatility serves more than 500 institutional clients and 130,000 retail customers. Now, we're bringing this expertise to MBS data and analytics.

Discover the benefits of using IVolatility solutions for Mortgages:

Got a question or a comment?

We're here to serve IVolatility users and we welcome your questions or feedback about the MBS data insights discussed in this post. If there is something you would like us to address, we're always open to your suggestions. Please let us know!

Previous issues are located under the News tab on our website.